Award-winning PDF software

How to report sale of mobile home Form: What You Should Know

Pay Tax When Moving Into Your Mobile Home To claim a deduction for your tax on a new mobile home when you move into it, you must follow the rules for sales and other property transactions in Pub. 501, Sales and Other Property, of the. These rules generally apply to every other type of personal property sale, including all other manufactured homes. There are two methods of completing any transfer of ownership: (1) you may complete and sign a mobile home title transfer form online; (2) you may complete and mail the transfer form to You are required to keep the forms for at least two years. To be able to complete a transfer of ownership, you must have met all the following requirements in the transfer process. You are the owner of the land, including the mobile home. You are the owner of the new mobile home. Furthermore, you and your spouse or common-law partner both have a legal right to live in the mobile home or house. Furthermore, you can identify a legal person to receive title and to have a legal transfer of ownership made, either by a certified copy of your spouse's or common-law partner's You will keep the old and new owners' list for at least two years. The information on it is for your use only. You will not distribute it without authorization from the current owner. To claim the exemption for the sale of a vacant mobile home: The vacant property must have no more than three owners. The owner who is the current owner must have an interest in the mobile home. The person to register title for the existing owner must file an assignment and notice to transfer with the Secretary of State. If any new owner (including the current owner) has an interest in the mobile home: The occupant's right or interest must be recognized by, or registered with, the Secretary of State. Within 1 year after the effective date of the transfer, the occupant must file notice of assignment to register with the Department. Within 1 year after the effective date of the registration, the occupant must file notice of transfer with the Secretary of State. You must have complied with all the above requirements for a real or personal property transfer. If you made any agreement or agreement arrangement to provide security for the property or to be the owner, the security obligation must be performed. Transfer of a Mobile Home From One Person to Another If a transfer of ownership of a mobile home occurs between two individuals, all the following things must occur.

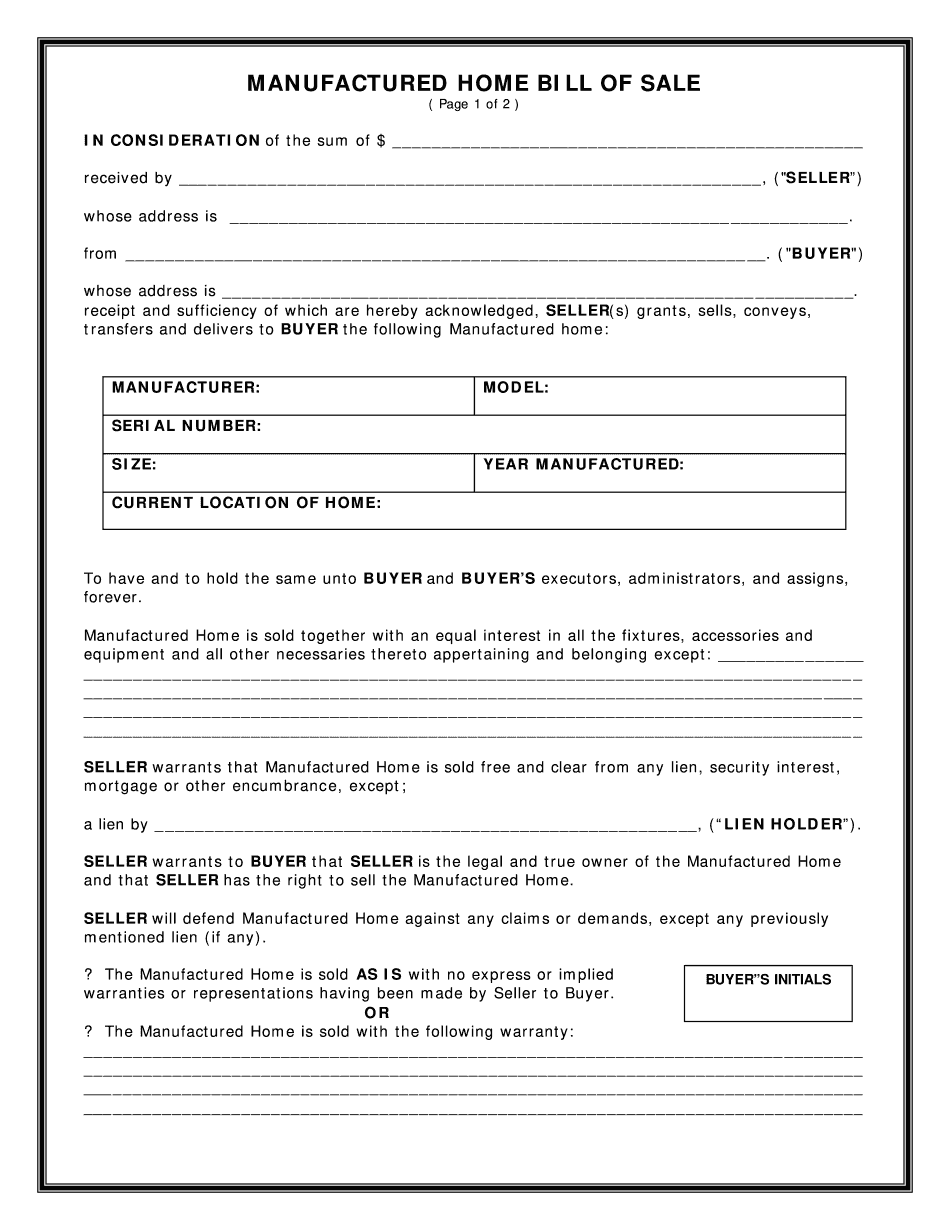

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Manufactured Home Bill Of Sale, steer clear of blunders along with furnish it in a timely manner:

How to complete any Manufactured Home Bill Of Sale online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Manufactured Home Bill Of Sale by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Manufactured Home Bill Of Sale from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.